Lights flicker, candles illuminate the room, and the secrets of forex trading unfold…

Welcome, fellow traders, to a world where mystical candlesticks hold the key to unlocking the hidden power of forex trading. Picture this: you’re sitting in front of your computer, analyzing charts, and puzzling over the best entry and exit points. But fear not, for in this blog post, we shall demystify the enigma of forex trading candlesticks and reveal their practical uses. So grab your favorite beverage, settle into your comfiest chair, and let’s dive into the enticing world of forex trading candlesticks.

Table of Contents

ToggleThe Dance of Candlesticks

Imagine stepping onto a dance floor where each candlestick represents market movements, emotions, and potential profit opportunities. These candlesticks, with their intriguing shapes and patterns, can provide valuable insights into the ebb and flow of the forex market. They are the footprints left behind by the bulls and bears, guiding us towards making smart trading decisions.

But what do these candlesticks signify? Allow me to shed some light. Each candlestick consists of a body and two wicks (or shadows). The body represents the price range between the opening and closing prices, while the wicks indicate the price extremes reached during the candle’s formation. By observing the interplay of these elements, we can gain a deeper understanding of market sentiment.

Decoding the Language of Candlesticks

Now that we have a basic understanding of candlestick anatomy, let’s explore their practical applications. Candlesticks come in various shapes and sizes, each carrying its own unique message. Here are a few noteworthy candlestick patterns:

Shaping Profits with Candlesticks

-

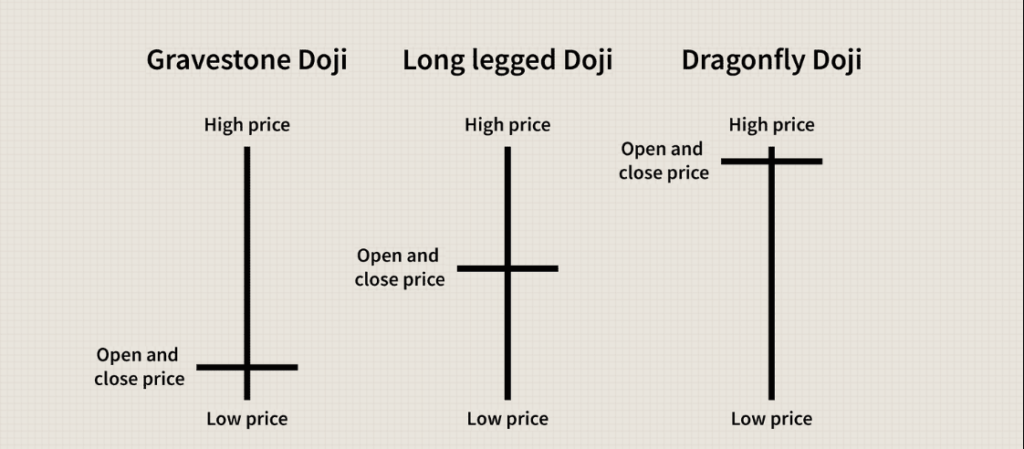

- Doji: Imagine a candlestick with no body, resembling a crossed road. This pattern suggests indecision in the market and signals a potential trend reversal. It’s like a cosmic wink, telling us to pay attention.

-

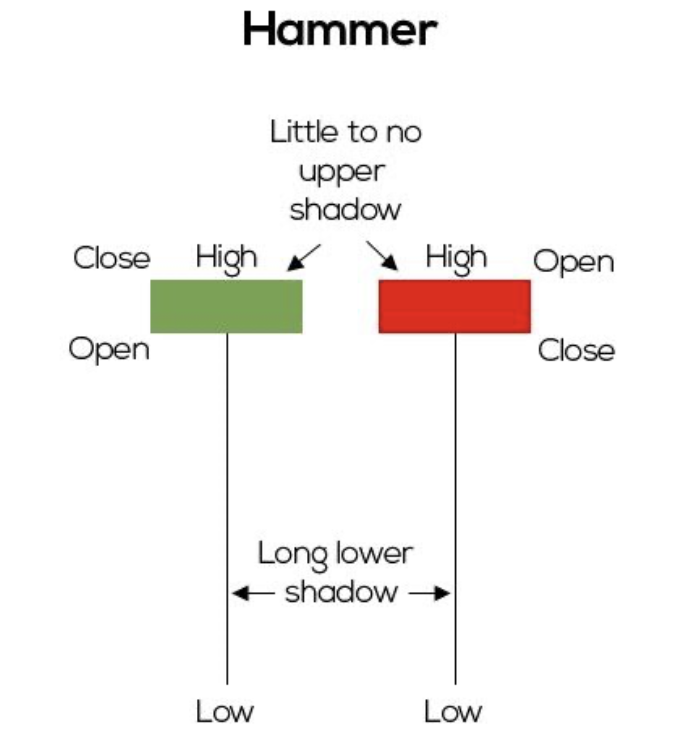

- Hammer: This bullish pattern appears after a downtrend, with a small body and a long lower wick. It represents a rejection of lower prices and indicates a possible trend reversal. It’s like a little hammer pounding the table, demanding our attention.

-

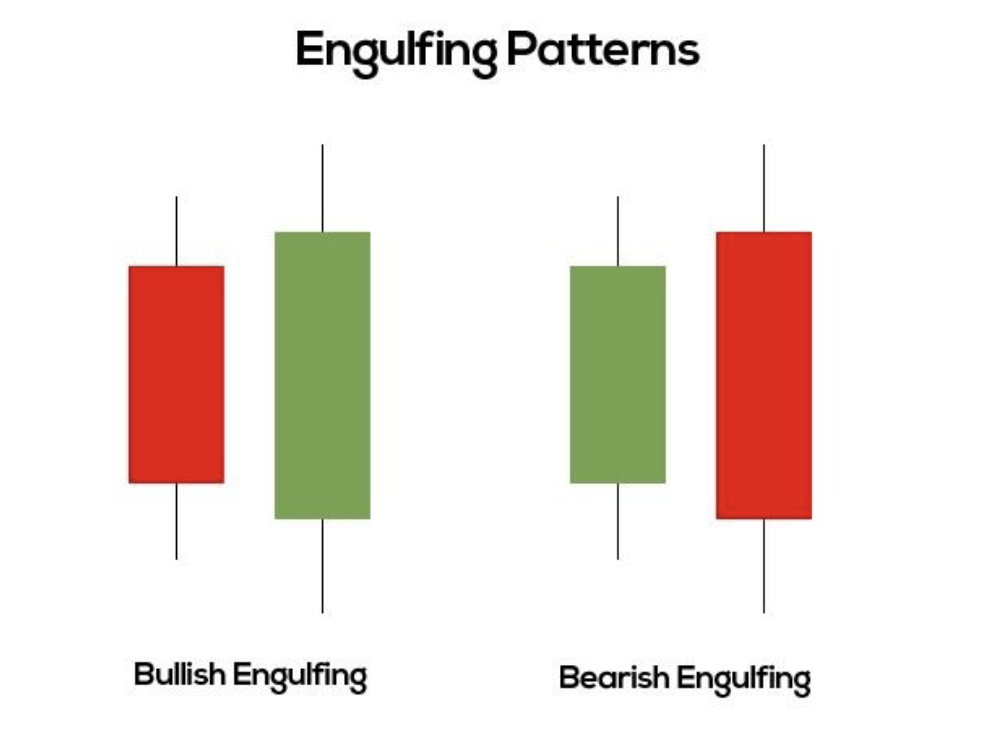

- Engulfing: Picture a voracious predator swallowing its prey whole. An engulfing pattern occurs when a larger candle completely engulfs the previous candle. It signifies a potential trend reversal and highlights a shift in market sentiment.

Now that we know how to interpret candlestick patterns, it’s time to put this knowledge into action. Here are a few tips on using candlesticks to make profitable trading decisions:

-

- Identify trends: Pay attention to the overall trend by looking at patterns formed by consecutive candlesticks. Are they predominantly bullish or bearish? This will help you determine the direction in which the market is moving.

-

- Confirm reversals: When you spot a potential reversal pattern, don’t jump the gun just yet. Look for confirmation from other indicators or candlestick formations. Remember, patience is a virtue in the world of trading.

-

- Set stop-loss orders: Candlestick patterns can also help you set appropriate stop-loss orders. By identifying key support and resistance levels, you can protect your capital and minimize potential losses.

Unveiling Valuable Resources

As promised, I wouldn’t leave you hanging without providing valuable resources to enhance your forex trading candlestick prowess. Take your forex trading game to the next level and explore more on forex trading candlesticks in our recommended website: CLICK HERE This treasure trove of knowledge will equip you with the tools needed to decipher the secrets hidden within candlesticks.

So, dear readers, as we bring this journey to a close, remember that forex trading candlesticks are more than mere lines on a chart. They hold the power to guide us through the treacherous waters of the forex market. Embrace their mystique, learn from their tales, and may your trading journey be filled with success and prosperity.

Disclaimer: Trading involves risk and should be approached with caution. This blog post is for informational purposes only and does not constitute financial advice.